Earn Money Back On Your Purchases With Cashback Credit Cards

by Mia Moore

published – July 13th 2020

As soon as we hear the dreaded word “credit card“, we are reminded of just how dangerous they can be. It also highlights the risks attached to them. Let’s face it, they have a bad reputation.

Credit cards have many obvious negatives. These include the severity of debt. Additionally, there is a fear of mounting interest a person might find themselves easily trapped in. Nobody wants the grey cloud of owing money hanging over them.

Well, there is no denying the downsides and I’m not here to argue that particular point. However, this is not the whole truth in regard to credit cards either, especially cashback credit cards.

There is a silver lining that a lot of people aren’t aware of. If you choose to take advantage of this then you could end with money in your pocket. Let’s explore the world of saving money with cashback credit cards together.

Is there a right way to use cashback credit card?

A credit card itself is not bad in its own right. It all depends who owns the credit card on how they use it. A reckless credit card holder might run into trouble. Whereas, it might be smooth sailing for a more sensible individual.

Like everything has its advantages and disadvantages, similar is the case with credit cards.

You can either haphazardly misuse them, sink into debt and rack up a serious amount of interest. On the other hand, you can sign up for a cashback credit card. With this, you can utilize an intelligent and methodical approach by using it to save money.

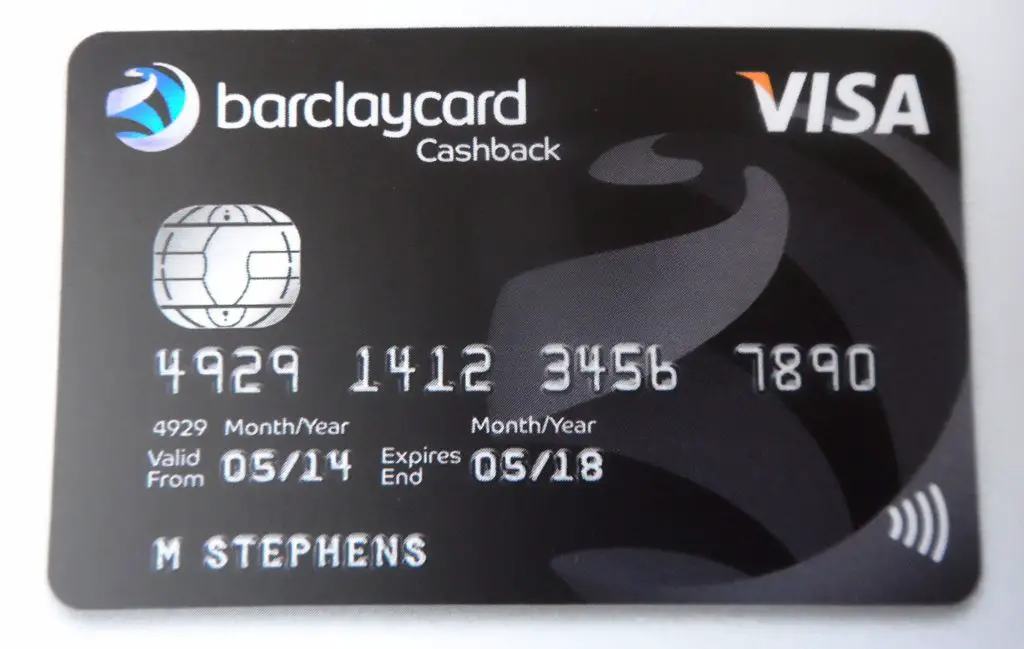

What is a cashback credit card?

Let’s talk about what cashback credit cards are exactly. How do I use a cashback credit card? How do I save money with it?

As the name suggests, a cashback credit card gives you a certain percentage of money back. This will happen whenever you buy something.

Moreover, this is a very beneficial feature to have with a credit card. This is true seeing as they aren’t typically designed to earn people money at all.

Cashback credit cards allow you to save money often. You can’t say the same when paying with cash. This is also the case when using a standard credit card that doesn’t offer the benefit of gaining cashback.

Are there other benefits to cashback credit cards?

There are several different ways you can save money by using cashback credit cards. In like manner, some credit card companies offer rewards to customers. These might be incentives such as coupons and gift vouchers.

Are there any other platforms that offer cashback too?

The cashback feature isn’t exclusive to cards alone. You can also take advantage of your purchasing habits and save money in other ways. It may be smart to pick a current account that offers cashback as well.

There are even specific cashback websites that you can sign up to as well. Two of the best and most generous paying platforms are topcashback and quidco. They both offer a high percentage of cashback for many different products and services.

Why should I use this payment method over cash itself?

The best way to save money is to use a cashback credit card as an alternative to cash. Preferably, do this for all your purchases, whenever possible.

This is because whenever you buy something with cash, you do not get a penny in return. What’s the point? You may as well take advantage of every opportunity (to save money) that comes your way.

I think we can all agree that this is better than earning nothing. It is still relevant even if the amount doesn’t seems that much at first.

Who should use a cashback credit card?

If you use this payment method regularly then all these little cashback returns will add up quickly.

Cashback credit cards are especially profitable for a shopaholic who just love to splurge their money around. Although, this can be counterproductive if your goal is to save money. I would advise that you only use it to make essential purchases.

Is this an effective way of saving money?

Other people have successfully tried and tested this technique of saving money before.

There are instances where consumers have acquired several different cashback credit cards. They have then spent money with this payment method as they would normally do.

At the end of the year, it was clear that they had witnessed a noticeable amount of money saved through this. This is much more money than they would have usually saved without the help of a cashback credit card.

Do these types of credit card come with any fees or charges?

Before thinking about acquiring a cashback credit card, make sure you are fully aware of what the annual fee. Check if there is even a yearly fee for the card at all. Likewise, consider any other additional fees and hidden charges too.

Is it possible to lose money with a cashback credit card?

Many times, people are frugal and don’t end up spending a lot with their cashback credit card. This can bite you in the ass if you’re not careful.

The annual fee might be quite high. It could be so high that it completely overshadows the reimbursements of a cashback credit card.

In the end, you might not save any money at all from this venture. Even worse, you may lose money if the fees are higher than the potential cashback earnings. This is one of the few scenarios where infrequent spending can get you into trouble.

What should I do with earnings from cashback credit cards?

People save money for all sorts of things. However, there doesn’t always need to be any rhyme or reason for it. If you do want to set a goal for yourself, then that’s good.

One of the most important things is to keep reminding yourself of where your cashback earnings are actually going to.

Is there a good way to keep track of my earnings?

It might give you some peace of mind to transfer your earned cashback to a separate bank account.

This should make the whole process less complicated. Your savings won’t get lost and jumbled up with the credit on your other cards and accounts either.

What should I use a cashback credit card for?

The most vital thing to take into account is that you should aim to use a cashback credit card solely for saving purposes (and that alone).

If you want this to work then It’s not supposed to be used for anything else. This includes borrowing money you don’t currently have. You can’t think about cashback credit cards in this way.

Understandably, this really flies in the face of the logic of credit card. I totally get this. For this reason, you shouldn’t act how you would normally act with a regular credit card.

How do I avoid paying interest on my cashback credit card?

One has to make sure that he or she is paying off all his or her credit card bills every month. This way there will be no interest amount to pay.

This is paramount if you wish to save money with cashback credit cards. The interest built up can easily cancel out any financial progress made.

You will need to ensure you do this if you want the cashback credit card to effectively make money for you. Let me reiterate, if you go about this the wrong way then you will essentially be shooting yourself in the foot.

Can I automatically pay off my cashback credit card?

It might be wise to arrange for your bank to automatically pay off any credit card debt. You can do this at the end of each month via another one of your accounts.

You should be able to do this by setting up a direct debit. Sorting this out from the get-go will mean one less thing for you to worry about.

Mentioned above are a few tips on how you can save money by using a cashback credit card. The key is to choose a card that makes it easy for you to save money.

Some cashback credit cards even give incentives to the cardholder for depositing the cashback received into a separate savings account. Ensure you choose one which makes everything simple and clear for you.

We can learn the importance of avoiding fees and any interest payments by paying off your cashback credit card every month. If neglected, the interest will undo all of your hard work.

We also know that using a cashback credit card the right way is dependent on the spending and temperament of the cardholder. If the individual spends money fairly often but at the same time is sensible then this is ideal. They should do just fine.

I recommend your next move should be to perform your own research. Compare all the different cashback credit cards on the market.

You can then pick out the best one that preferably has a high percentage cashback payment. Check reviews and testimonials of other cardholders in order to find a card that best suits you.

I also suggest setting up a savings account especially for depositing money earned with your cashback credit card. This will prevent your earnings from being mixed up with all your other money.

There are many other ways that you can save money in regards to your purchases. This is especially true with grocery shopping too. For instance, you can Scan Bar Codes & Earn Big Rewards With Shop and Scan.

Do you think it’s worth getting a cashback credit card? What do you like and dislike about cashback credit cards?

Please don’t forget to share this with your friends and like it on social media. You can subscribe to our newsletter and comment below too. Thanks for reading!

Related Posts:

Receive Infinite Free Samples & (Almost) Never Shop Ever Again!

Want A Lifetime Supply Of Free Eggs? Learn The Tricks Of Keeping Chickens!

Sick Of Grocery Shopping? Grow Food In Your Garden & Save Money!